GST changes bring relief to small businesses

On 6th October, 2017, the GST council under the Chairmanship of the Union Minister of Finance and Corporate Affairs, Arun Jaitley held a meeting to review the impact, concerns and progress of the tax regime. The meeting also focused on bringing in necessary changes for the benefit of tax payers.

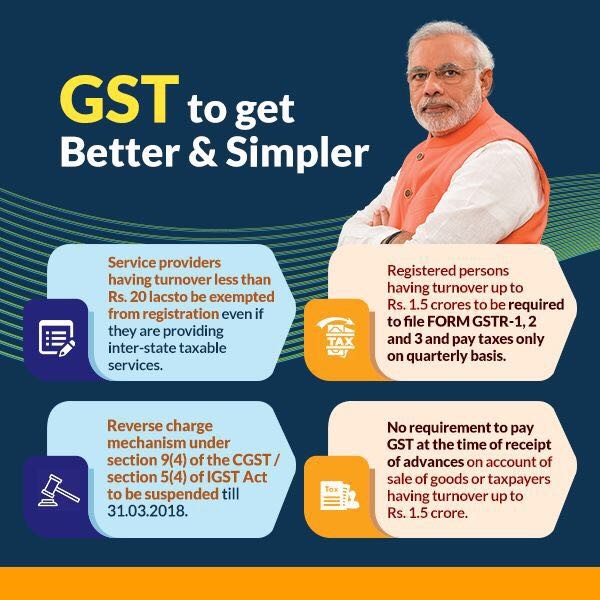

The changes made during the meeting will have far reaching effects as well as bring semblance in the workings of the three month old indirect tax regime. Among the many changes, one that brings much relief to small entrepreneurs is the relaxation offered in terms of submission of tax.

Benefitting 90% of the tax payer base, the new rule states that businesses with annual turnover of up to Rs 1.5 crore can now file quarterly income returns and pay tax instead of the current provision of monthly filings.

Changes have also been made in the composition scheme in GST. Earlier the threshold was Rs. 75 lakh which has risen to Rs 1 crore for businesses to avail the composition scheme. Under the scheme, a taxpayer is required to file summarized returns on a quarterly basis, instead of three monthly returns. Further, traders, manufacturers and restaurants will pay 1 per cent, 2 per cent and 5 per cent respectively under composition scheme though service providers cannot opt for the scheme.

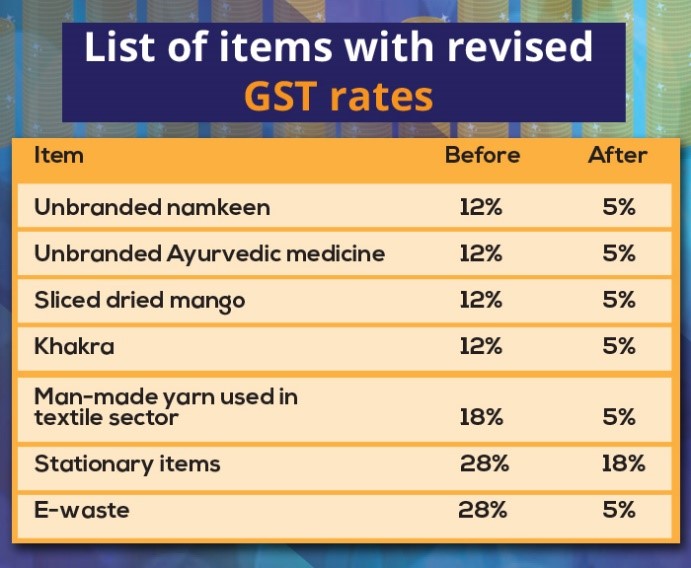

Another welcome change comes in the form of reduction in prices on as many as 27 items. GST on unbranded ayurvedic medicine, unbranded namkeen, Khakra and sliced dried mango has been reduced to 5 per cent from 12 per cent. GST on man-made yarn used in textile sector has also seen a reduction from the earlier 18% to 12 percent.

During the meeting, it was decided that the e-way bill system will be introduced with effect from 1st January, 2018 and will be applicable nationwide with effect from 1st April, 2018. The decision has been taken in an effort to give the traders and industry more time to understand the process of the GST regime.

GST which was rolled out three months ago is an effort to bring the country under a transparent and accountable system. Encouraging ease of doing business, small entrepreneurs and foreign investment, the initial months of the regime may be unsteady but are necessary to perfect the policy for the fulfillment of larger goals. The Government’s initiative to take quick action and tackle the concerns of GST payers is a big step forward in strengthening the policy’s foundation and in turn assuring the country’s progress.

Total Comments - 0