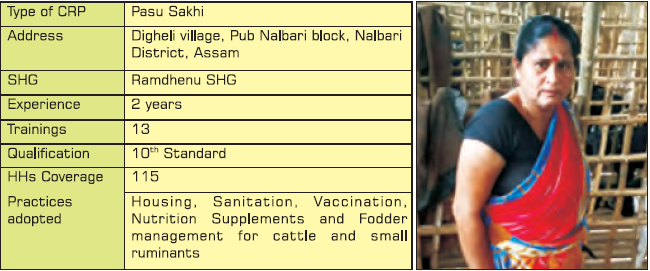

Insuring livestock for livelihoods – Dipali Devi

The journey of Mrs. Dipali Devi started as a member of the Ramdhenu SHG under Swarna Jayanti Gram Swarojgar Yojana (SGSY) way back in 2009. However, the group could not sustain due to lack of livelihood activities for its member and improper repayment within the group. The SHG was revived in 2013 under Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY -NRLM), and after a few years of initial up and downs, the members finally decided to take their future in their own hands and adopted improved livelihood practices for ensuring a sustainable income.

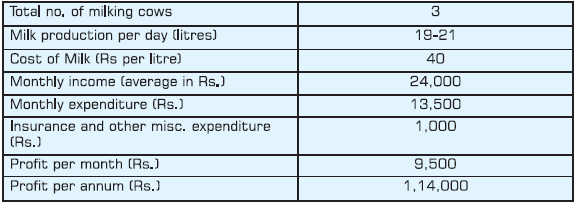

She started a dairy farm with a milking cow of the local breed during March 2013 by investing an amount of Rs 15,000 which she took as a loan from her SHG. She started selling 2 to 3 litres of milk to local people daily and started earning profits and thus gradually started her dairy farm. In November 2015, the SHG received a bank loan of Rs 2 lakh from Assam Gramin Vikash Bank, Nalbari. She availed a loan of Rs. 60,000 to purchase a cow of improved breed. Again, in January 2016, she got a dairy loan of Rs. One lakh with a subsidy amount of Rs. 25,000 from National Bank for Agriculture and Rural Development (NABARD) and invested the amount in the renovation of the dairy farm and purchased another cow with a price of Rs. 72,000. She spent the remaining amount for revolving cost and extension for cowshed under the close guidance of livestock professionals from Assam SRLM.

Economics of her Dairy farming

Her initiatives on dairy farming have influenced other women in her village, and they have taken up similar activity for their livelihood. She maintains the sanitation and hygiene of the cowshed properly. Once a month, she hires local help to clean the shed properly and does all the cleaning herself daily. Apart from that, she understood the need for life insurance of the livestock and was the first in the village to do the same. Like the famous saying “through others we live ourselves”; other women in the village are motivated to follow the same.

Seeing the success of her dairy farm, she has recently bought 12 goats and started goat rearing along with dairy farming. For goats also, she focuses on building proper sheds, its cleanliness and insurance of the animals before the flood season comes.

According to her, “I have seen people doing insurance of their cars and bikes as soon as they buy it. Then I came with the idea of insuring my animals, who are the main source of livelihoods for my family. I will also encourage others to do so”.